Unlocking the Value of Your Household Goods: A Guide to Tax-Deductible Donations

Related Articles: Unlocking the Value of Your Household Goods: A Guide to Tax-Deductible Donations

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Unlocking the Value of Your Household Goods: A Guide to Tax-Deductible Donations. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unlocking the Value of Your Household Goods: A Guide to Tax-Deductible Donations

The act of donating pre-loved household items to charitable organizations is often driven by a desire to help those in need. However, it is also a valuable opportunity to reduce your tax liability. Understanding the tax implications of such donations can be a powerful incentive to declutter and contribute to a worthy cause. This guide aims to demystify the process of determining the tax-deductible value of your household items, providing a comprehensive overview of the key considerations and benefits.

The Foundation of Deductibility: Fair Market Value

The cornerstone of tax-deductible donations lies in the concept of "fair market value." This refers to the price a willing buyer would pay for an item in an open and competitive market, not what you paid for it originally. The fair market value is not a subjective assessment; it is determined by various factors, including:

- Condition of the Item: Items in excellent condition, free from wear and tear, command a higher value than those with visible damage or signs of age.

- Demand and Popularity: The demand for a particular item in the market plays a significant role. Certain brands, styles, or vintage pieces may hold greater value than more generic items.

- Rarity and Collectibility: Unique or rare items, especially those with historical significance or collectible value, can significantly impact their market value.

- Functionality: Items that are fully functional and operational generally have a higher value than those that are damaged or require repairs.

Navigating the Valuation Process: Tools and Resources

Determining the fair market value of household items can be a challenging task. However, various tools and resources can assist in this process:

- Online Marketplaces: Websites like eBay, Craigslist, and Etsy provide insights into the prices of similar items being sold by individuals. This can be a valuable starting point for assessing the value of your donations.

- Antique and Collectible Dealers: If you believe you have items of significant value, consulting with local antique dealers or appraisers can provide professional opinions.

- Charity Organizations: Many charities have their own guidelines and resources for estimating the value of donated items. It is advisable to contact the organization directly to inquire about their specific procedures.

- Professional Appraisers: For valuable items or complex donations, engaging a qualified professional appraiser is recommended. They can provide a detailed assessment and documentation that can be used for tax purposes.

Documentation is Key: Proving Your Deduction

To claim a tax deduction for your donated items, you must provide adequate documentation. This typically involves:

- Receipt from the Charity: Obtain a written receipt from the charity acknowledging the donation. This receipt should include the date of the donation, a description of the items, and the estimated fair market value.

- Appraisal Report: If you have used a professional appraiser, ensure you obtain a written appraisal report that includes the date of the appraisal, the appraiser’s qualifications, and a detailed description of the items.

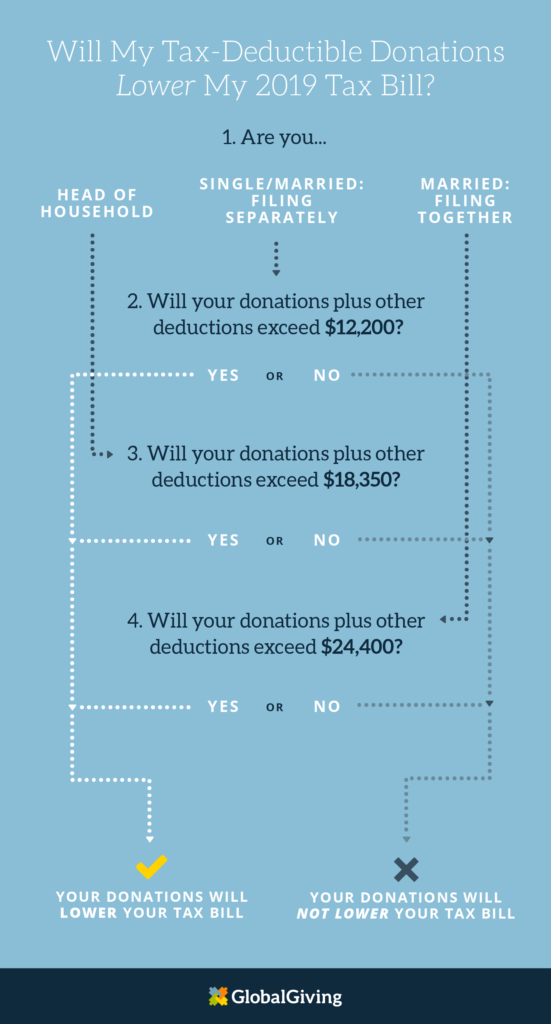

Tax Deduction Limits and Thresholds

The IRS sets specific limits on the amount of tax deductions you can claim for charitable donations. The deduction is generally capped at 60% of your Adjusted Gross Income (AGI) for cash contributions and 30% of your AGI for non-cash contributions. However, specific rules may apply to certain types of donations, including household items.

Understanding the Benefits of Donating Household Items

Beyond the potential tax benefits, donating your household items offers a range of advantages:

- Environmental Sustainability: Donating items instead of discarding them helps reduce waste and promote resource conservation.

- Community Support: Your donations provide essential resources to those in need, contributing to the well-being of your community.

- Personal Satisfaction: The act of giving back can bring a sense of fulfillment and satisfaction.

FAQs: Demystifying the Process

Q: What types of household items are typically tax-deductible?

A: Most household items are eligible for tax deductions, including furniture, appliances, clothing, books, electronics, toys, and sporting equipment. However, certain items, such as food or perishable goods, may not be deductible.

Q: What if I don’t know the fair market value of my items?

A: If you are unsure of the value, you can use a conservative estimate based on online marketplaces or charity guidelines. It is better to underestimate than to overestimate the value.

Q: Do I need to donate to a registered charity?

A: Yes, to claim a tax deduction, the recipient organization must be a qualified charitable organization registered with the IRS.

Q: How do I track my donations for tax purposes?

A: Keep a detailed record of your donations, including the date, description of the items, and the estimated fair market value. This documentation will be crucial when filing your tax return.

Tips for Maximizing Your Donation Value

- Clean and Repair: Before donating, ensure your items are clean and in good working order. This can significantly increase their value.

- Research Local Charities: Identify charities that accept the types of items you want to donate and inquire about their specific guidelines.

- Consider a Donation Drop-Off Event: Many communities host donation events where you can drop off your items and receive a receipt on the spot.

- Consult with a Tax Professional: For complex donations or if you have questions about the tax implications, consult with a qualified tax professional.

Conclusion: Unlocking Value and Making a Difference

Donating household items is a rewarding act that can benefit both the recipient organization and your own tax situation. By understanding the process of determining fair market value, gathering the necessary documentation, and following IRS guidelines, you can maximize the tax benefits of your donations. Remember, every donation, regardless of size, makes a difference in the lives of others. By choosing to give back, you contribute to a more sustainable and compassionate society.

Closure

Thus, we hope this article has provided valuable insights into Unlocking the Value of Your Household Goods: A Guide to Tax-Deductible Donations. We hope you find this article informative and beneficial. See you in our next article!