The Shifting Sands of Value: A Comprehensive Exploration of What Holds Worth in the 21st Century

Related Articles: The Shifting Sands of Value: A Comprehensive Exploration of What Holds Worth in the 21st Century

Introduction

With great pleasure, we will explore the intriguing topic related to The Shifting Sands of Value: A Comprehensive Exploration of What Holds Worth in the 21st Century. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Shifting Sands of Value: A Comprehensive Exploration of What Holds Worth in the 21st Century

The concept of value is inherently subjective, shaped by individual preferences, cultural norms, and the ever-changing tides of the global market. What holds significance today may be obsolete tomorrow, highlighting the dynamic nature of what is deemed valuable and worth money. This exploration delves into the diverse facets of value, examining tangible assets, intangible concepts, and emerging trends that shape the landscape of wealth in the 21st century.

Tangible Assets: The Foundation of Traditional Value

For centuries, tangible assets have formed the bedrock of wealth, offering a tangible representation of value that can be readily exchanged. These assets, encompassing physical objects with intrinsic worth, can be categorized into various forms:

1. Real Estate: A Foundation of Stability and Growth

Land and property have historically been regarded as a cornerstone of wealth, providing both a place to live and a potential source of income. The value of real estate is influenced by factors such as location, size, condition, and market demand. While real estate can offer stability and potential appreciation, it also requires significant investment and ongoing maintenance.

2. Precious Metals: A Haven in Times of Uncertainty

Gold, silver, and platinum have long been considered safe-haven assets, their value often rising during economic instability or political turmoil. These metals possess intrinsic value and are readily tradable, making them a popular choice for diversification within investment portfolios. However, the value of precious metals can fluctuate significantly, and their storage and security require careful consideration.

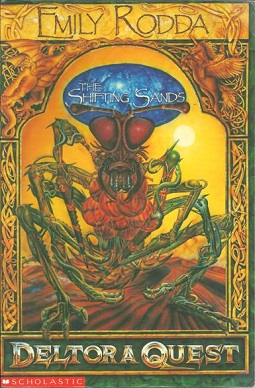

3. Collectibles: A Blend of Passion and Investment

Collectibles, ranging from rare stamps and vintage cars to fine art and antique furniture, hold value due to their rarity, historical significance, or aesthetic appeal. The market for collectibles is often driven by passion and speculation, with prices fluctuating based on market trends and individual preferences. While some collectibles can appreciate significantly in value, others may remain stagnant or even depreciate.

4. Commodities: The Backbone of Global Trade

Commodities, encompassing raw materials like oil, natural gas, and agricultural products, are essential for various industries and economies. Their value is determined by supply and demand dynamics, influenced by factors such as weather patterns, political events, and technological advancements. Investing in commodities can offer diversification and potential returns, but it also carries inherent risk due to market volatility.

Intangible Assets: The Rise of Intellectual Capital

Beyond tangible assets, intangible concepts are increasingly recognized as drivers of value in the modern economy. These assets, often representing knowledge, creativity, and innovation, are becoming increasingly important in a world driven by information and technology:

1. Intellectual Property: The Engine of Innovation

Patents, trademarks, and copyrights protect intellectual creations, granting exclusive rights to their creators and offering a tangible form of value. Intellectual property can generate revenue through licensing, royalties, or the sale of the underlying technology or design. As innovation accelerates, the value of intellectual property is likely to continue to grow.

2. Human Capital: The Power of Knowledge and Skills

The knowledge, skills, and experience of individuals are increasingly recognized as valuable assets. Human capital contributes significantly to the success of businesses and organizations, driving innovation, productivity, and economic growth. Investing in education, training, and development programs can enhance human capital and increase its value.

3. Brand Reputation: A Foundation of Trust and Loyalty

A strong brand reputation, built on trust, quality, and customer satisfaction, can be a significant asset for businesses. A well-established brand can command higher prices, attract loyal customers, and create competitive advantages. Building and maintaining a strong brand reputation requires consistent effort and a commitment to ethical practices.

Emerging Trends: The Future of Value

The landscape of value is constantly evolving, driven by technological advancements, societal shifts, and changing consumer preferences. Several emerging trends are shaping the future of what holds worth:

1. Digital Assets: The Rise of Cryptocurrencies and NFTs

Cryptocurrencies, like Bitcoin and Ethereum, and non-fungible tokens (NFTs) are gaining traction as digital assets with potential value. Their decentralized nature and use in blockchain technology have attracted significant interest, though their long-term viability and regulation remain uncertain.

2. Data: The New Gold Rush

Data is increasingly recognized as a valuable asset, enabling businesses to gain insights, improve decision-making, and personalize customer experiences. The value of data is further enhanced by its ability to be analyzed and used to create new products and services.

3. Sustainability: The Ethical Imperative

Environmental consciousness and sustainable practices are becoming increasingly important, influencing consumer preferences and investment decisions. Companies that prioritize sustainability, reducing their environmental footprint and promoting social responsibility, are likely to gain a competitive advantage and attract investors.

FAQs: Navigating the Landscape of Value

1. What factors determine the value of an asset?

The value of an asset is influenced by a complex interplay of factors, including:

- Supply and Demand: The scarcity or abundance of an asset relative to demand significantly impacts its value.

- Utility: The usefulness or functionality of an asset contributes to its perceived value.

- Risk and Uncertainty: The potential for loss or fluctuation in value can influence an asset’s perceived worth.

- Market Sentiment: The overall perception and expectations of market participants can impact asset prices.

- Inflation and Interest Rates: Economic factors like inflation and interest rates can affect the purchasing power and attractiveness of various assets.

2. How can I determine the value of an asset?

Determining the value of an asset can be complex and requires careful consideration of various factors. Some common methods include:

- Market Comparison: Comparing the asset to similar ones sold recently in the market can provide a benchmark for its value.

- Income Approach: Estimating the potential income generated by the asset can be used to determine its value.

- Cost Approach: Estimating the cost to replace or replicate the asset can provide an indication of its value.

- Valuation Models: Various financial models can be used to assess the value of assets based on specific variables and assumptions.

3. What are some tips for investing in assets that hold value?

Investing in assets that hold value requires careful research, planning, and diversification. Some tips include:

- Understand your risk tolerance: Determine your willingness to accept potential losses and choose investments accordingly.

- Diversify your portfolio: Spread your investments across different asset classes to mitigate risk.

- Conduct thorough research: Research potential investments carefully, considering factors such as market trends, company performance, and future prospects.

- Seek professional advice: Consider consulting with a financial advisor to develop a personalized investment strategy.

- Be patient and disciplined: Investing is a long-term endeavor, and it’s important to remain patient and avoid impulsive decisions.

4. How can I protect the value of my assets?

Protecting the value of your assets requires proactive measures to mitigate risks and preserve their worth. Some key strategies include:

- Regular maintenance: Ensure that tangible assets like real estate and vehicles are maintained regularly to preserve their condition and value.

- Insurance coverage: Protect your assets from unforeseen events like natural disasters, theft, or accidents through appropriate insurance policies.

- Diversification: Spread your investments across different asset classes to reduce the impact of potential losses in any single asset.

- Secure storage: Store valuable assets like precious metals and collectibles in safe and secure locations to prevent theft or damage.

- Stay informed: Stay updated on market trends, economic conditions, and regulatory changes that could impact the value of your assets.

Conclusion: The Evolving Nature of Value

The landscape of what holds value is constantly shifting, reflecting the dynamic nature of the global economy, technological advancements, and evolving societal priorities. While tangible assets continue to hold significance, intangible concepts like intellectual property, human capital, and brand reputation are increasingly recognized as drivers of wealth. Emerging trends, such as digital assets, data, and sustainability, are further shaping the future of value, emphasizing the importance of adaptability, innovation, and a long-term perspective. Understanding the forces that shape value and embracing a diversified approach to investment can help individuals and organizations navigate the ever-changing landscape of wealth in the 21st century.

Closure

Thus, we hope this article has provided valuable insights into The Shifting Sands of Value: A Comprehensive Exploration of What Holds Worth in the 21st Century. We appreciate your attention to our article. See you in our next article!