The Essential Guide to Renting a House: A Comprehensive Overview

Related Articles: The Essential Guide to Renting a House: A Comprehensive Overview

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Essential Guide to Renting a House: A Comprehensive Overview. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Essential Guide to Renting a House: A Comprehensive Overview

Securing a rental property is a significant step in one’s life, requiring careful planning and a thorough understanding of the process. This guide provides a comprehensive overview of the essential elements involved in renting a house, from initial research to signing the lease agreement.

Understanding the Rental Market

Before embarking on the rental journey, it is crucial to gain a clear understanding of the local rental market. Factors such as average rental prices, availability of properties, and neighborhood characteristics should be carefully considered. Online real estate platforms, local newspapers, and real estate agents can provide valuable insights into the market dynamics.

Establishing Your Financial Standing

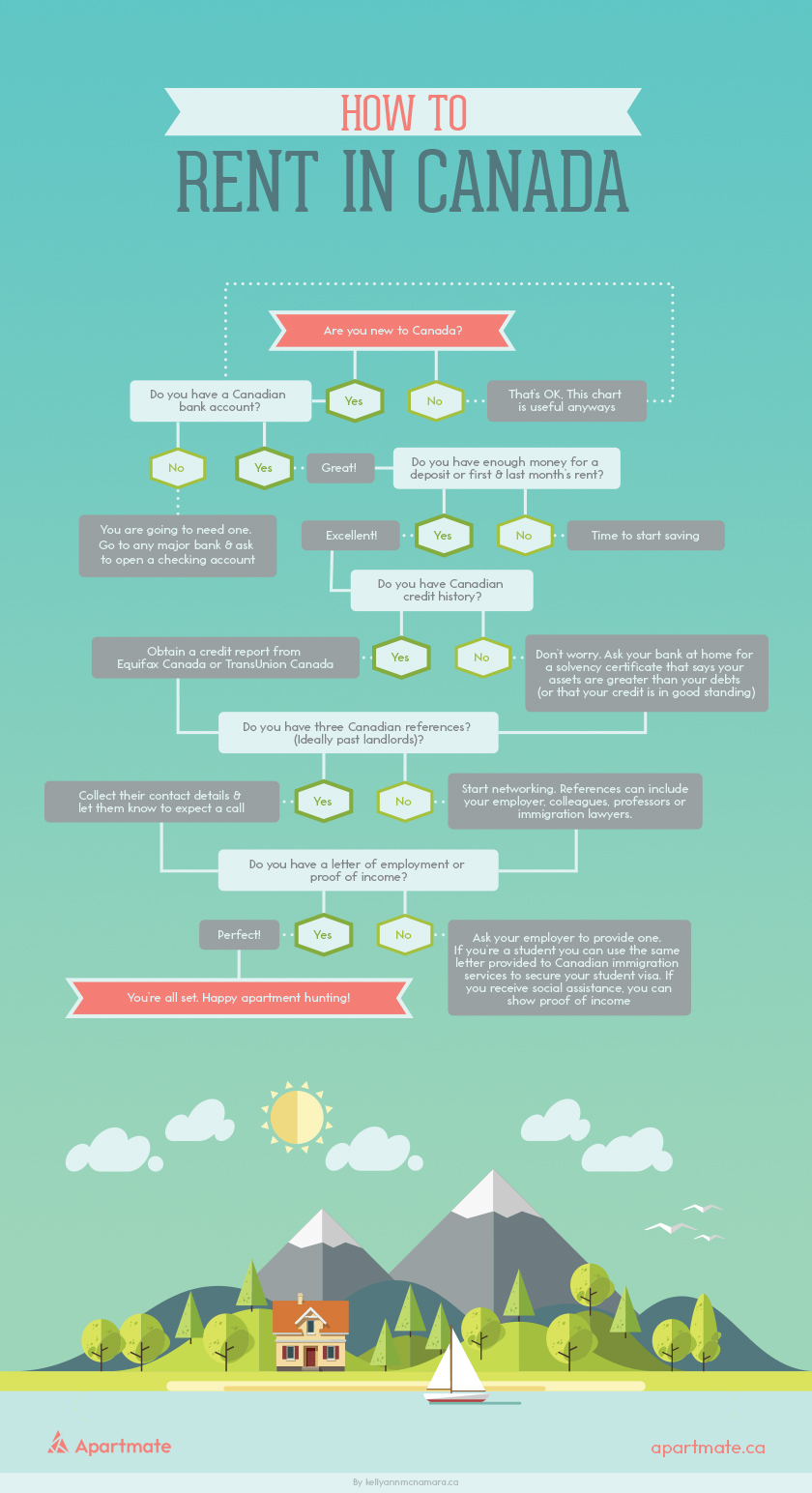

Landlords typically assess potential tenants’ financial stability to ensure they can meet their rental obligations. This involves evaluating credit history, income, and employment history. A strong credit score and consistent income demonstrate financial responsibility and increase the likelihood of approval.

Essential Documents for Rental Applications

The rental application process often requires the submission of various documents to verify identity, income, and employment history. These documents typically include:

- Proof of Identity: Driver’s license, passport, or government-issued ID card.

- Proof of Income: Pay stubs, tax returns, bank statements, or employment verification letters.

- Credit Report: A copy of your credit report from a reputable credit bureau.

- Rental History: Previous landlord references or rental agreements.

- Bank Statements: Proof of sufficient funds to cover the security deposit and first month’s rent.

The Importance of a Strong Credit History

A strong credit history is a cornerstone of securing a rental property. It demonstrates responsible financial management and reassures landlords of your ability to pay rent on time. A good credit score can significantly improve your chances of approval and potentially secure favorable lease terms.

Understanding Lease Agreements

The lease agreement is a legally binding contract outlining the terms and conditions of the tenancy. It is essential to thoroughly review the lease before signing, paying close attention to:

- Rental Period: The duration of the lease agreement.

- Rent Amount: The monthly rent payment and due date.

- Security Deposit: The amount required as a refundable deposit against potential damages.

- Utilities: The responsibility for paying utilities such as water, electricity, and gas.

- Pet Policy: Restrictions or requirements regarding pets.

- Maintenance Responsibilities: The landlord’s and tenant’s responsibilities for repairs and maintenance.

- Termination Clause: Provisions for early termination of the lease.

Negotiating Lease Terms

While standard lease agreements exist, it is often possible to negotiate certain terms to better suit your needs. This could include adjusting the rental period, negotiating a lower rent amount, or clarifying specific maintenance responsibilities.

The Role of a Real Estate Agent

Engaging a real estate agent can streamline the rental process. Agents have access to a wider range of properties, possess market knowledge, and can assist with negotiation and paperwork. Their expertise can save time and effort while ensuring a smoother rental experience.

Tips for Finding the Right Rental Property

- Define your needs and priorities: Consider your budget, desired location, and preferred amenities.

- Research potential neighborhoods: Explore local amenities, transportation options, and community characteristics.

- Attend open houses: Visit properties in person to assess their condition and suitability.

- Ask questions: Don’t hesitate to inquire about any concerns or uncertainties.

- Compare different options: Evaluate multiple properties before making a decision.

FAQs: Addressing Common Rental Questions

Q: What is a security deposit, and why is it required?

A: A security deposit is a refundable amount paid upfront to cover potential damages to the property during the tenancy. It is returned to the tenant upon moving out, minus any deductions for repairs or cleaning.

Q: What is a credit check, and how does it impact my rental application?

A: A credit check assesses your credit history, including payment history, outstanding debts, and credit utilization. A good credit score increases your chances of approval, while a poor credit score may lead to rejection or require additional financial guarantees.

Q: What are the common utilities included in rent?

A: Utilities included in rent vary depending on the property and local regulations. Common utilities include water, electricity, gas, and trash collection. It’s crucial to clarify which utilities are included in the rent before signing the lease.

Q: What are the tenant’s responsibilities for maintenance and repairs?

A: The lease agreement typically outlines the tenant’s responsibilities for routine maintenance, such as cleaning and minor repairs. However, major repairs and maintenance are generally the landlord’s responsibility.

Q: What are the consequences of breaking a lease agreement?

A: Breaking a lease agreement can result in financial penalties, such as forfeiture of the security deposit or payment of a lease-breaking fee. It’s essential to understand the terms and consequences of early termination before signing the lease.

Tips for a Successful Rental Experience

- Communicate effectively with your landlord: Promptly address any issues or concerns.

- Maintain the property responsibly: Keep the property clean and in good condition.

- Respect the lease agreement: Adhere to the terms and conditions outlined in the lease.

- Pay rent on time: Avoid late payments and potential penalties.

- Document all interactions: Maintain records of communication and payments.

Conclusion

Renting a house requires careful planning, thorough research, and a comprehensive understanding of the process. By following the steps outlined in this guide, potential renters can navigate the rental market confidently, secure a suitable property, and establish a successful tenancy. Remember, clear communication, responsible behavior, and adherence to the lease agreement are crucial for a positive rental experience.

Closure

Thus, we hope this article has provided valuable insights into The Essential Guide to Renting a House: A Comprehensive Overview. We appreciate your attention to our article. See you in our next article!