The American Spending Paradox: Where Does Our Money Go?

Related Articles: The American Spending Paradox: Where Does Our Money Go?

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The American Spending Paradox: Where Does Our Money Go?. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The American Spending Paradox: Where Does Our Money Go?

The United States, a nation of unparalleled economic power, is also a nation of consumers. While this consumerism fuels the engine of the American economy, it also leads to a fascinating paradox: a simultaneous desire for financial security and a tendency towards excessive spending. This article delves into the various areas where American consumers often find themselves parting with their hard-earned dollars, examining the motivations behind these expenditures and their potential impact on individual and national well-being.

The Allure of Convenience: Subscription Services and Fast Food

Convenience is a highly valued commodity in the modern world, and Americans readily embrace services that streamline their lives. Subscription services, ranging from streaming platforms to meal kits and even clothing rental programs, offer a seemingly effortless solution to everyday needs. While these services provide convenience and access to a wide range of options, the monthly fees can add up quickly, often without conscious awareness.

Similarly, fast food provides a quick and affordable solution for busy individuals and families. However, the frequent consumption of processed and calorie-dense meals can lead to health issues and financial strain in the long run.

The Pursuit of Material Possessions: The Temptation of Consumerism

The American culture is deeply intertwined with consumerism, often equating material possessions with happiness and success. This mindset fuels a constant desire for the latest gadgets, trendy clothing, and luxurious experiences. While these purchases can provide temporary satisfaction, they often come at a significant financial cost.

Moreover, the constant bombardment of advertising and marketing campaigns can create a sense of dissatisfaction with one’s current possessions, leading to a cycle of impulsive purchases and unnecessary spending.

The Hidden Costs of Entertainment and Leisure

Entertainment and leisure are essential for maintaining a healthy work-life balance, but the costs associated with these activities can be surprisingly high. Americans spend significant amounts on movie tickets, concerts, sporting events, and vacations. While these experiences provide valuable memories and opportunities for relaxation, it is important to be mindful of the financial implications.

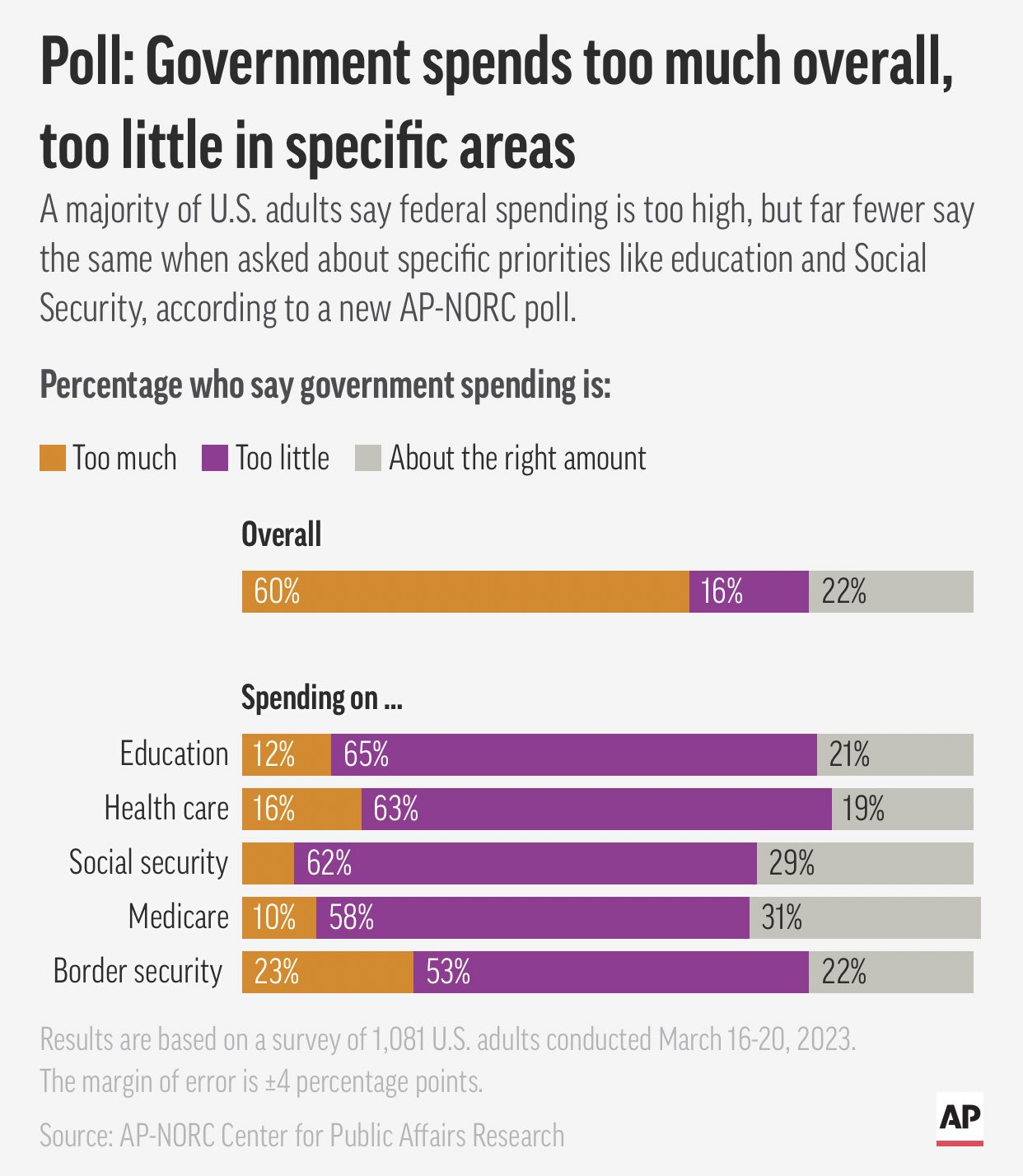

The Growing Burden of Healthcare and Education

Healthcare and education are fundamental pillars of a healthy society, but their costs are steadily rising in the United States. Healthcare expenses, including insurance premiums, deductibles, and out-of-pocket costs, can be a major financial burden for many Americans. Similarly, the rising cost of higher education, including tuition fees and living expenses, can create significant debt for students and their families.

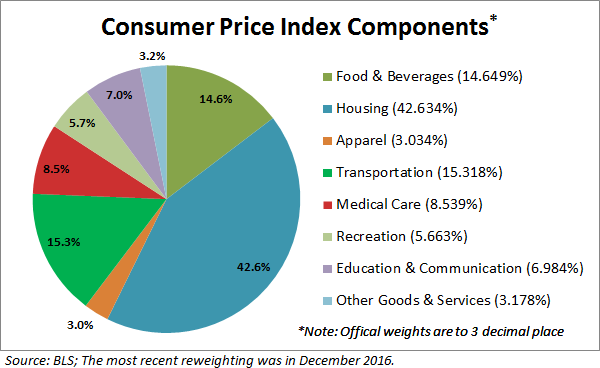

The Unforeseen Costs of Homeownership

Homeownership is often considered a cornerstone of the American dream, but the associated expenses can be substantial. In addition to the mortgage payment, homeowners must factor in property taxes, insurance, maintenance, and repairs. These costs can vary significantly depending on the location and size of the property, potentially creating a significant financial strain.

The Impact of Unmanaged Spending

The consequences of excessive spending can be far-reaching, impacting both individual finances and the overall economy. Unmanaged spending can lead to:

- Increased personal debt: This can include credit card debt, student loans, and personal loans, which can negatively impact credit scores and future borrowing opportunities.

- Reduced financial security: Excessive spending can deplete savings and make it difficult to reach financial goals, such as retirement or emergency funds.

- Stress and anxiety: Financial worries can contribute to stress, anxiety, and relationship problems.

- Reduced economic growth: When a significant portion of consumer spending is directed towards unnecessary purchases, it can divert resources from more productive investments.

FAQs

Q: How can I identify areas where I am overspending?

A: Regularly track your spending using a budgeting app or a spreadsheet. Categorize your expenses and identify areas where you are spending more than you intended.

Q: What are some strategies for reducing unnecessary spending?

A: Create a realistic budget and stick to it. Set financial goals and prioritize spending based on your values. Avoid impulse purchases and practice delayed gratification.

Q: How can I save money on healthcare and education?

A: Shop around for health insurance plans and consider alternatives like telehealth services. Explore scholarships, grants, and financial aid options for higher education.

Q: What are some tips for managing homeownership expenses?

A: Regularly maintain your property to prevent costly repairs. Shop around for insurance quotes and consider energy-efficient upgrades to reduce utility bills.

Tips for Responsible Spending

- Create a budget: This is the foundation of responsible spending. Track your income and expenses to understand your financial situation and set realistic spending limits.

- Set financial goals: Having clear goals, such as saving for retirement, a down payment on a house, or a dream vacation, can help you prioritize spending and stay motivated.

- Practice delayed gratification: Before making a purchase, consider if it is truly necessary and if you can wait a few days or weeks before buying it. This allows you to avoid impulse purchases and make more informed decisions.

- Look for deals and discounts: Take advantage of sales, coupons, and loyalty programs to save money on everyday purchases.

- Avoid unnecessary debt: Use credit cards responsibly and avoid carrying high balances. If you need to borrow money, shop around for the best interest rates and repayment terms.

- Automate savings: Set up automatic transfers from your checking account to your savings account to ensure you are consistently saving money.

- Seek financial advice: If you are struggling to manage your finances, consider seeking advice from a financial advisor or credit counselor.

Conclusion

The American spending habits are a complex tapestry woven from convenience, consumerism, and cultural norms. While these factors contribute to a vibrant economy, they also present challenges for individual financial well-being. By understanding the areas where Americans often overspend and adopting responsible spending habits, individuals can make informed choices that contribute to their financial security and overall well-being.

Closure

Thus, we hope this article has provided valuable insights into The American Spending Paradox: Where Does Our Money Go?. We hope you find this article informative and beneficial. See you in our next article!