Strategic Spending: Maximizing Value with a $500 Budget

Related Articles: Strategic Spending: Maximizing Value with a $500 Budget

Introduction

With great pleasure, we will explore the intriguing topic related to Strategic Spending: Maximizing Value with a $500 Budget. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Strategic Spending: Maximizing Value with a $500 Budget

A $500 budget offers a surprising degree of flexibility for acquiring essential items, enhancing daily life, or investing in personal growth. The key to maximizing this sum lies in understanding individual needs and prioritizing purchases that deliver the most value. This article explores various categories of goods and services within this budget, providing insights into their potential benefits and considerations for informed decision-making.

Essential Purchases:

- Clothing: A $500 budget can furnish a wardrobe with essential items. Focusing on high-quality basics like t-shirts, jeans, and a versatile jacket ensures longevity and practicality. Online retailers often offer discounts and sales, allowing for greater value.

- Kitchenware: Investing in quality kitchenware can significantly enhance the cooking experience. A good set of knives, a sturdy cast-iron skillet, and a high-quality blender are invaluable additions. Consider durable materials like stainless steel and cast iron for long-lasting performance.

- Electronics: A budget of $500 can secure a reliable smartphone, a compact Bluetooth speaker, or a budget-friendly tablet. Researching specifications and comparing prices from different retailers can yield significant savings.

- Tools: A well-stocked toolbox is essential for basic home repairs and projects. A hammer, screwdriver set, pliers, and a measuring tape form a solid foundation. Investing in quality tools ensures durability and longevity.

- Home Decor: A $500 budget allows for enhancing home aesthetics with decorative elements. A statement rug, a few throw pillows, or a set of framed prints can add personality and warmth to a space.

- Books: Books provide knowledge, entertainment, and inspiration. A $500 budget allows for acquiring a substantial collection of both physical and digital books, catering to individual interests.

- Experiences: While tangible goods are appealing, allocating a portion of the budget towards experiences like concerts, museum visits, or weekend getaways can enrich life. These experiences create lasting memories and foster personal growth.

Investing in Personal Growth:

- Online Courses: A $500 budget can provide access to valuable online courses in diverse fields like coding, photography, or business. These courses offer skill development and career advancement opportunities.

- Software Subscriptions: Investing in software subscriptions can streamline workflows, boost productivity, and enhance creative endeavors. Options include graphic design software, productivity tools, and language learning platforms.

- Fitness Equipment: A budget of $500 can purchase a quality exercise bike, a set of dumbbells, or a yoga mat, promoting physical well-being and fitness goals.

- Financial Planning: Seeking professional financial advice can be a wise investment. A consultation with a financial advisor can provide guidance on budgeting, saving, and investing, leading to long-term financial stability.

Considerations for Informed Spending:

- Research and Comparison: Before making a purchase, thorough research and comparison are crucial. Explore different brands, models, and retailers to find the best value for the budget.

- Quality over Quantity: Prioritizing quality over quantity is essential for maximizing value. Investing in durable and well-crafted items ensures longevity and minimizes the need for frequent replacements.

- Needs vs. Wants: Differentiating between needs and wants is crucial for responsible spending. Focusing on essential items and delaying non-essential purchases can prevent overspending.

- Delayed Gratification: Instead of impulsive purchases, consider delaying gratification to ensure the purchase aligns with long-term goals and needs.

- Utilizing Discounts and Sales: Leveraging discounts, sales, and promotional offers can significantly stretch the budget. Online retailers often offer attractive deals and coupons.

FAQs:

Q: What are some budget-friendly ways to improve home decor?

A: Consider repurposing existing furniture with paint or fabric, adding plants for natural vibrancy, and utilizing affordable wall decor like framed prints or tapestries.

Q: How can I find quality clothing within a $500 budget?

A: Focus on timeless basics like t-shirts, jeans, and a versatile jacket from reputable brands known for quality. Utilize online retailers for sales and discounts.

Q: What are some essential tools for basic home repairs?

A: A hammer, screwdriver set, pliers, measuring tape, and a level are essential for most basic home repairs. Consider investing in a multi-tool for added versatility.

Q: What are some budget-friendly ways to improve fitness?

A: A yoga mat, resistance bands, and bodyweight exercises provide a comprehensive workout routine without expensive gym memberships.

Q: How can I find reputable online courses within my budget?

A: Explore platforms like Coursera, Udemy, and edX, which offer a wide range of courses at varying price points. Look for courses with high ratings and positive reviews.

Tips for Maximizing Value:

- Set a Budget and Stick to It: Define a clear budget and avoid exceeding it, even for tempting deals.

- Prioritize Needs: Focus on essential items and delay non-essential purchases.

- Shop Smart: Utilize online retailers for discounts and sales, and compare prices across different stores.

- Consider Secondhand Options: Thrift stores and online marketplaces offer affordable and sustainable alternatives for clothing and home decor.

- Invest in Quality: Prioritize durable and well-crafted items that will last longer, minimizing the need for replacements.

- Save for Future Purchases: Allocate a portion of the budget towards savings for future purchases, allowing for larger investments in the future.

Conclusion:

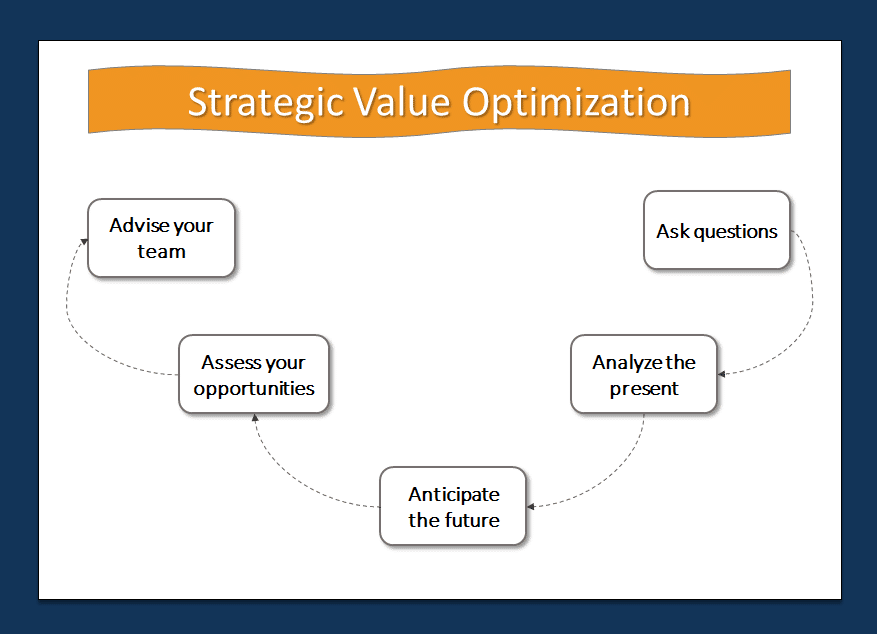

A $500 budget, while seemingly modest, offers significant potential for acquiring essential items, investing in personal growth, and enhancing daily life. By understanding individual needs, prioritizing purchases, and employing strategic spending strategies, this budget can be maximized to deliver lasting value. The key lies in informed decision-making, research, and a commitment to responsible spending habits.

Closure

Thus, we hope this article has provided valuable insights into Strategic Spending: Maximizing Value with a $500 Budget. We thank you for taking the time to read this article. See you in our next article!