Navigating the Landscape of Liquid Assets: A Comprehensive Guide

Related Articles: Navigating the Landscape of Liquid Assets: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Landscape of Liquid Assets: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Liquid Assets: A Comprehensive Guide

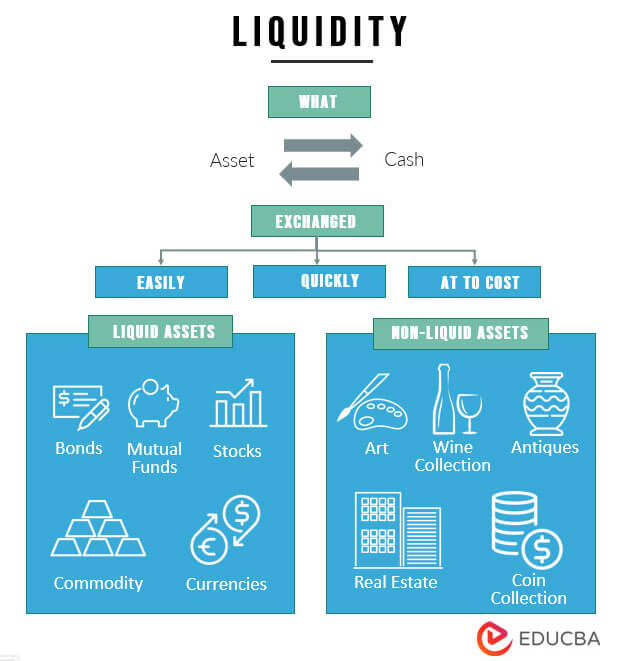

In the realm of finance, the concept of liquidity plays a pivotal role. It essentially signifies the ease with which an asset can be converted into cash without significant loss of value. Understanding the various types of liquid assets and their nuances is crucial for individuals and organizations alike, as it empowers them to manage their financial resources effectively and navigate market fluctuations with greater confidence.

Understanding Liquid Assets: A Foundation for Financial Stability

Liquid assets are the cornerstone of financial stability, providing a buffer against unforeseen circumstances and facilitating strategic financial decisions. Their ability to be readily converted into cash offers flexibility and enables individuals and businesses to:

- Meet Short-Term Obligations: Liquid assets are readily available to cover immediate expenses, ensuring timely payment of bills, rent, or other financial commitments.

- Seize Opportunities: Having liquid assets at hand allows for quick action when lucrative investment opportunities arise, minimizing the risk of missing out due to insufficient capital.

- Weather Financial Storms: In times of economic uncertainty or personal emergencies, liquid assets provide a safety net, allowing individuals and businesses to weather financial storms without resorting to drastic measures.

- Manage Cash Flow: Liquid assets play a crucial role in managing cash flow, ensuring sufficient funds are available to meet ongoing operational needs and maintain a healthy financial position.

Types of Liquid Assets: A Spectrum of Options

The world of liquid assets encompasses a diverse range of options, each with its unique characteristics and suitability for specific financial goals.

1. Cash and Cash Equivalents:

- Cash: The most liquid asset, readily available for immediate use.

- Checking Accounts: Offer easy access to funds via checks, debit cards, or electronic transfers.

- Savings Accounts: Provide a safe haven for short-term savings, typically offering lower interest rates than other investment options.

- Money Market Accounts: Offer higher interest rates than savings accounts, with limited check-writing privileges.

- Certificates of Deposit (CDs): Offer fixed interest rates for a specified period, limiting access to funds until maturity.

2. Marketable Securities:

- Stocks: Represent ownership in publicly traded companies, offering potential for capital appreciation and dividends.

- Bonds: Debt securities issued by governments or corporations, providing fixed interest payments and potential for capital appreciation.

- Mutual Funds: Diversified portfolios of stocks, bonds, or other assets managed by professional fund managers.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, but traded on stock exchanges like individual stocks, offering greater flexibility and potential for lower costs.

3. Other Liquid Assets:

- Precious Metals: Gold, silver, and platinum are often considered safe-haven assets, offering potential for price appreciation during economic uncertainty.

- Real Estate: While typically considered illiquid, certain types of real estate, such as rental properties or vacation homes, can be readily sold or leased, generating income and providing liquidity.

- Cryptocurrencies: Digital currencies like Bitcoin and Ethereum have gained popularity as potential investment assets, although their volatility and regulatory uncertainty make them riskier than traditional assets.

Navigating the Landscape: Considerations for Liquid Asset Allocation

The optimal mix of liquid assets for any individual or organization depends on a variety of factors, including:

- Financial Goals: Short-term goals, such as saving for a down payment on a house, may necessitate a higher proportion of cash or cash equivalents, while long-term goals, such as retirement planning, may allow for a greater allocation to stocks or other growth-oriented investments.

- Risk Tolerance: Individuals with a higher risk tolerance may be comfortable holding a larger portion of their assets in volatile but potentially high-yielding investments, while those with a lower risk tolerance may prefer a more conservative approach with a greater allocation to cash or cash equivalents.

- Time Horizon: The length of time an individual or organization has to reach their financial goals influences the appropriate asset allocation. Longer time horizons allow for greater exposure to potentially higher-yielding but more volatile investments, while shorter time horizons may necessitate a more conservative approach.

- Market Conditions: Economic and market conditions can impact the performance of different asset classes. During periods of economic uncertainty, it may be prudent to hold a larger proportion of assets in cash or cash equivalents, while during periods of economic growth, a greater allocation to stocks or other growth-oriented investments may be warranted.

FAQs by Types of Liquid Assets:

Cash and Cash Equivalents:

-

Q: What are the advantages and disadvantages of holding cash?

- A: Cash offers immediate liquidity and security but may lose value over time due to inflation.

-

Q: How do I choose between a checking account and a savings account?

- A: Checking accounts offer easy access for everyday expenses, while savings accounts provide a safe haven for short-term savings with potentially higher interest rates.

-

Q: What are the risks associated with money market accounts?

- A: While offering higher interest rates than savings accounts, money market accounts may have limited check-writing privileges and may be subject to interest rate risk.

-

Q: How do CDs work, and what are the risks?

- A: CDs offer fixed interest rates for a specified period, but early withdrawal may result in penalties.

Marketable Securities:

-

Q: What are the different types of stocks, and how do they differ?

- A: Stocks can be categorized as common stock (representing ownership with voting rights) or preferred stock (offering fixed dividends and priority over common stockholders in case of liquidation).

-

Q: How do I choose the right bond for my portfolio?

- A: Bond selection depends on factors like maturity date, credit rating, and interest rate.

-

Q: What are the differences between mutual funds and ETFs?

- A: Mutual funds are actively managed and typically have higher fees, while ETFs are passively managed and typically have lower fees.

Other Liquid Assets:

-

Q: What factors should I consider when investing in precious metals?

- A: Precious metals can provide a hedge against inflation and economic uncertainty, but their price fluctuations can be volatile.

-

Q: How can real estate generate liquidity?

- A: Rental properties or vacation homes can generate income through rent or short-term rentals, providing a source of cash flow.

-

Q: What are the risks associated with investing in cryptocurrencies?

- A: Cryptocurrencies are highly volatile, lack regulatory oversight, and may be susceptible to fraud or hacking.

Tips by Types of Liquid Assets:

Cash and Cash Equivalents:

- Tip: Maintain an emergency fund of 3-6 months’ worth of living expenses in a readily accessible account.

- Tip: Explore high-yield savings accounts or money market accounts to maximize returns on your savings.

- Tip: Consider using a budgeting app to track your spending and ensure you have sufficient funds for essential expenses.

Marketable Securities:

- Tip: Diversify your investments across different asset classes and sectors to mitigate risk.

- Tip: Research companies and bonds before investing, considering their financial health, growth prospects, and credit ratings.

- Tip: Seek professional financial advice to develop an investment strategy that aligns with your risk tolerance, time horizon, and financial goals.

Other Liquid Assets:

- Tip: When investing in precious metals, consider reputable dealers and storage options to protect your investment.

- Tip: If investing in real estate, carefully evaluate rental income potential, property management costs, and potential for appreciation.

- Tip: Proceed with caution when investing in cryptocurrencies, considering the inherent risks and potential for fraud.

Conclusion: Mastering the Art of Liquidity

Understanding the nuances of liquid assets is paramount to achieving financial stability and security. By carefully assessing individual needs and goals, and strategically allocating assets across various options, individuals and organizations can create a robust financial foundation that enables them to navigate market fluctuations, seize opportunities, and weather financial storms with confidence. As the financial landscape evolves, staying informed about the latest trends and developments in the world of liquid assets remains crucial for making sound financial decisions and achieving long-term financial success.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Liquid Assets: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!